Surprising design Ostrichpillow

These guys have a real fresh and liberating view on design.

AI No Excuse

It’s not my rant, but once you think about something a certain way, you tend to find more support for that opinion.

Vincent Cerf: AI Is Not An Excuse!

Dijkstra Q&A

Found this on geekchic.com, a website that has disappeared, but the wayback machine caught it.

- What is your programming language of choice? my own (Algol? – Kneut)

- What is your favorite operating system? I don’t use a computer

- Do you have a hero or role model? not really

- What is your favorite kind of music? chamber music

- What is your favorite news group? I don’t use a computer

- What is your favorite web page (besides geekchic!)? I don’t use a computer

- What sports do you enjoy? none

- What kind of car do you drive? AUDI 4000

- What hobbies do you enjoy outside of work? music, photography, camping

- What is your favorite book (or author)? Dorothy L. Sayers

- What is your favorite movie? Roman Holiday

- What sort of clothing do you usually wear to work? informal, T-shirt, sandals

- What is your favorite food? soups

EWD139 – On punch cards for the X8

It is quite astonishing. In EWD 139 – written in the first half of the 1960s – Dijkstra argues why their to-be build Dutch computer the EL (Electologica) X8 should no longer be equipped with a punch card reader. Looking back, for at least for twenty more years after this article (IBM) computers were still being equipped with punch card readers.

Photograph copyright Mr. J.A. Th. M. van Berckel.

Not only is Dijkstra very clear with his arguments, but he is so much opposed to the punch card that finds that having to write them down he finds, very Dijkstra-ish, a test of his decency. His arguments are the following.

The punch card technology has become obsolete. It is simply not needed anymore, there is paper tape now (this is the time before terminals and time-sharing).

The way you must use punch cards, the “style”, leads to local solutions for reliability (parity checks) instead of structural redundancy solutions over the entire document.

The limitation of 80 characters leads to technical “ad hoc” conventions and constraints, and limits the ability to improve the readability of programs.

Finally, Dijkstra argues that a single card does not have information value. You need the whole stack, on the right order. Which makes punch cards very impractical to use.

Dijkstra concludes the article that is so much a Dijkstra paragraph, that I can not leave it out.

“Hier wil ik het bij laten. Als mensen mij komen vertellen, dat zij met recht van ponskaarten gebruik gemaakt hebben, dan verandert die mededeling minder aan mijn opinie over ponskaarten, dan over de man.Ik concludeer dan, dat deze man voldoende inventief of ordelijk geweest is om van een in wezen ongezond middel gezond gebruik te maken. Als pleidooi voor het medium – ik kan niet anders – is zo’n mededeling zonder enig effect.”

In my imperfect english:

“I will leave it with that. If people come tell me that they have rightfully used punch cards, than that statement changes less in my opinion about punch cards, than about the man. I conclude then, that the man has been sufficiently inventive or orderly to use an essentially unhealthy tool in a healthy manner. As a appeal for the medium – I can not do other – such a statement is without any effect.”

To think you have to be two persons

To think you have to be two persons (or more) at the same time. And you have to disagree with yourself (make sure the one person thinks up ways to justify the opinion of the second person). You have to tolerate conflict, negotiate, compromise. Adjust your thinking.

More importantly, you must not only question your own opinion, but you have to ignore the public opinion.

(After Jordan Peterson)

Peterson’s rules for supporting arguments

Reading Jordan Peterson’s 12 Rules for Life. Many of the foundations for his rules he enforces using the stories and metaphors from the bible. A bit too much to my taste, but

I am willing to agree that a lot of wisdom is gathered in this book. However, when Peterson cites Adolf Hitler to support his arguments that people should not live with lies, I wonder what he was thinking. Does he really think quoting Hitler would enforce his viewpoint in the mind of any decent person?

Facebook en Twitter: wantrouw onze content

Is het tijd is om definitief Facebook en Twitter gedag te zeggen? Beide weigeren om aantoonbaar onjuiste uitspraken van politici te verwijderen uit betaalde content. Het zou gaan om nieuwswaardige feiten, die ze niet willen censureren. Daarmee geven deze bedrijven een aantal belangrijke signalen omtrent hun moraal:

- Politici mogen liegen, en wij bieden ze er een kanaal voor.

- Leugens zijn nieuwswaardig.

- De platformen hanteren een nieuwswaardigheidsnorm bij het censureren van berichten op hun platforms, welke kennelijk belangrijker is dan de waarheidsnorm.

Wat beide organisaties niet lijken te bezeffen is dat politici zo makkelijk liegen op Twitter en Facebook, juist is omdát het laagdrempelige mogelijkheden biedt om leugens onder een groot publiek te verspreiden. En deze laagdrempeligheid geeft Twitter en Facebook de morele verantwoordelijkheid om kaf van koren te scheiden op hun platform.

Wellicht belangrijker voor deze platforms is dat het prioriteren van nieuwswaardigheid boven waarheid ook op al hun goedbedoelende adverteerders op het platform neerslaat.

“Alle content op onze platforms zijn potentiële leugens”, zeggen Facebook en Twitter.

Ik denk dat ze daarmee hun eigen graf graven. Ze leven tenslotte van advertenties. Maar mogelijk komen ze tot bezinning komen en hun suffe beslissing terug draaien.

Machine, Platform, Crowd by authors by McAfee and Brynjolfsson

In Machine, Platform, Crowd, authors McAfee and Brynjolfsson describe three major developments that led to the enormous economic change we have seen over the past decades.The rapid developments in technology (machine) led to possibilities of the forming of powerful new layers that bring consumers and producers closer together (platforms), and how these platform thrive through direct involvement of the consumer in the production and dissemination of the product and services provided through the platforms.

How can companies like Uber, Facebook, Amazon have become so big and influential, considering they are only thin layers? These platforms do not produce goods, and have no or little assets (at least at the outset).

In the book many aspects around these developments are brought together. The authors contrast the old world and the new world: machines versus human intelligence, platform versus product, crowd versus core (core meaning something driven by an organisational structure).

Picture by New America

Machines have developed that can crunch the new large volumes of data that the Internet era has enabled. Here we see that technological developments create their own new opportunities. The authors go into why these things are so hard to predict, and have no good answer. New technology enables things we can not foresee. We can dream, but technology continues to surprise us.

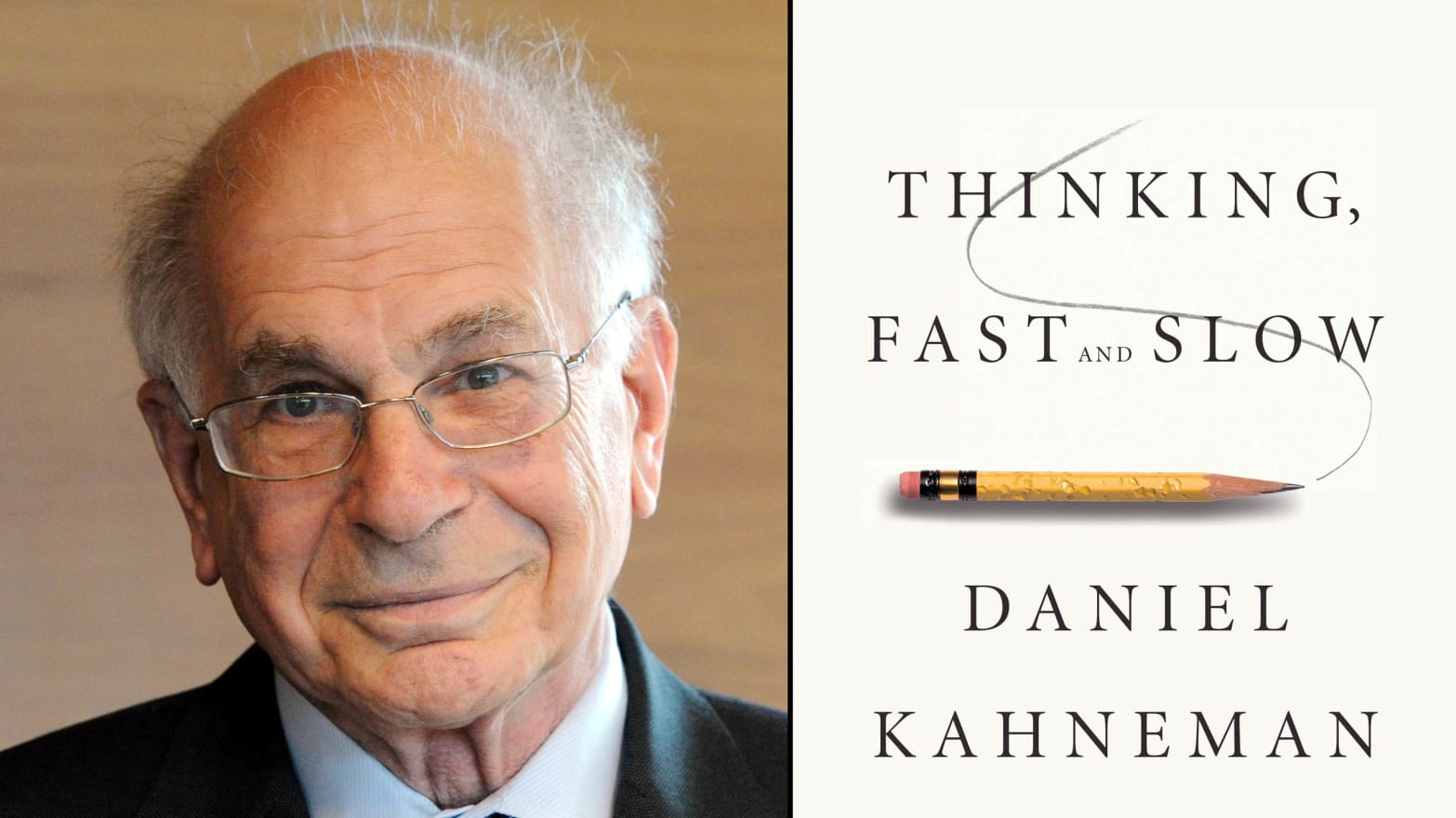

The developments of AI have been an important factor. But why computers are better than humans at making (some) decisions.The book goes back to the literature of Kahneman and others. Kahneman has learned us that our decision making is highly subjective and prone to errors. Fast decision making is done by our System 1 thinking, which is impulsive and subjective. Our System 2 is more thoughtful and slow, but tends not to correct System 1 decisions but rather justify those decisions.Our biases make us bad decision makers. And computers can ignore all the subjective crap that clutters our decision making. And of course they can very fast go through last piles of data.

Though McAfee also shows that if the AI is fed with “biased” data, the computer will also make biased decisions. But, the computer can be easily corrected, while for humans that is a lot more difficult.

In the end, the computer is better at doing specific things. (The worst are Hippo based decisions: Highest Paid Person’s Personal View. A problem common in organisations with narcissistic leaders.) AI is increasingly efficient at making decisions for “narrow” problems.Scientists however indicate that Artificial General Intelligence (AGI) – is a stage we now even getting close to.

The authors do not go into the hypes that are created around AGI. People like Harari in Homo Deus write extensive and interesting perspectives on what the world may become when AI takes over. But these are, I believe, not based on realistic views on the state on AI, or even on what AI might brings us in the future.McAfee and Brynjolfsson do not elaborate on this humbling perspective. They even ignore it later on, where the describe their believe that when given enough data, engineering knowledge, and requirements, computers will be able figure out novel ways to do things. This statement remains unsubstantiated and even contradicts their earlier statements about AGI from an MIT scientist.It is also contradictory to the Polanyi paradox: we do not know what we know. So that engineering knowledge may very well remain buried in human brain mass.Finally, to end this tangent, the claim itself seems somewhat circular. If I rephrase the statement: if we know what to do, how to do it, and have the right inputs, we can program a computer to do it. Well, of course, I would say, because that is as much as the definition of automation.

So how come we see this rise of AI technology now? McAfee and Brynjolfsson summarize:

- The availability of computing power. The power of CPUs and specially GPUs has reached a level that enabled and boosted the usability of neural network performance.

- The drastically decreased cost of computing.

- The availability of large amounts of data.

When will robots be used and when humans? Robots for Dull, Dirty, Dangerous work (DDD) and/or where Dear/Expensive resources are used.But coordination, teamwork, problem solving and very fine hand/foot/senses work is needed. These are all things computer and robot are not good at.Creative and social jobs are safe from robotisation.

Platforms have appeared that killed or diminished existing often large industries. Where products become digital, the fact that these are free (zero cost to copy) and perfect (no loss off quality when copying), economies have radically changed.Two ways are left to make money with these products:

- Unbundle products – like iTunes sells songs instead of albums.

- Rebundle products – like Spotify creates subscriptions instead of selling albums/songs.

Complements increase the sales of goods. Like apps increase the sales of iPhones. Free products can be bundled to make money out of them:

- Freemium products

- Put ads in free products

- Add customer service (open source products)

- Provide a public service (for public organisations)

- Pairing with products

For platforms, curation of products and reputation systems become crucial to filter and make products find-able to clients.Characteristics of successful platforms:

- Early – attract a crowd before others do

- Use economy of complementary products

- Open up the platforms

- Guarantee experience through curation/reputation like mechanisms.

Online-to-Offline platforms have emerged. these bring together products and consumers for a market that optimises asset utilisation. When their is a 2-sided market, demand want low prices from multiple suppliers, and supplier want their products in as many consumers as possible.Both sides want economies of scale.Is a product in undifferentiated, prices will come down. Such products are vulnerable for platform destruction.What is less vulnerable: complex services, markets with few participants.

How to make successfully use of crowd-sourced information?

- Make information findable and organise it

- Curate bad content

Crowd sourced platforms can only be successful when

- They are open

- Everyone can contribute (no credentials needed)

- Contributions can be verified and reversed (prevent destruction of the asset)

- They are self organising (distributed trust)

- They have a geeky leadership

The volume of the crowd knows more than a few experts.Crowd beats core.The core nowadays uses the crowd:

- To get things done (upwork)

- For finding a resource

- For market research

- To acquire new customers

- For acquiring innovation

Distrust in organisations leads to a wish for Decentralization of Everything. But “The Nature of the Firm” describes why organisations exist and why their is always a place for them.

The cost of linking parts of the supply chain in more expensive when it needs to be done with different players all the time.In an organisation that handles larger parts of the supply chain, cheap communication drives down costs.More importantly contracts are never complete.

There is always a thing called Residual Rights of Control over assets. The concept is not further elaborated. But in a distributed model the ownership of the produced assets poses problem: who owns the right over the assets.The problem seems incomplete and drives construction of firms.

Firms drive group work and management:

- To coordinate more complex work: transmission belts for coordination and organisational problem solving

- Human/social skills

- People want to work together

- Best way to get things done

They end with the question: what will we do with all that technology – that is the question we should answer, not: what will technology do with us.

Apply technology to solve real-word problems – in a combination of technology, humans, and other resources.

EWD 108 and EWD 116 – about the banker’s algoritm

In EWD 108 and EWD 116 Dijkstra describes the banker’s algoritm to prevent a so-called deadly embrace. This algoritm manages different scarce resources in such a manner that all in need for one or more of the managed resources, are guaranteed to get their hands on the resource at some point in time.

Of course, in computer science, a computer – it’s operating system – manages a number of resources that are required by the processes running on the computer. And how many resources each process needs is not known beforehand (and often dynamically determined).

The analogy used in the paper is that of a banker lending money to clients, with the complicating constraint that clients do not know beforehand exactly how much money they will need. So they can lend more funds later on.

The situation could occur that the banker has only left an x amount to lend out, and a client John comes with a request for an additional amount larger than x. The banker can only hope that one of the other clients will soon finish their business and return their money. Only then can the banker help John. If however none of the other clients however can finish their business without coming to the banker for an additional lending, the banker is in deep trouble. His clients are waiting for eachother to finish their business, but to finish the business they all need some more money which they all hold themselves. A deadly embrace – “dodelijke omarming”.

Paper EWD 108 is a first exploration of the algorithm.

The core of the algorithm is the “trick” that the sum of the amount lended + the maximum amount needed of the last lender accepted is never larger than the amount of money the banker has available. As such the banker can always guarantee that he will get the money back because the last lender can always be satisfied. So the last lender is a sort of clinet of last resort. She can always guarantee return to a safe state is possible. An because for that state the algorithm also guarantee (inductively) that: “the sum of the amount lended + the maximum amount needed of the last lender accepted is never larger than the amount of money the banker has available”. (All my words.)

EWD 108 describes a small banker’s algorithm in pseudocode. The algorithm is somewhat clumsily written, and (because it )holds a goto (!) (goto consideren harmful).

In EWD 116 the algorithm is refined, and no longer presented in pseudocode.The algorithm EWD 108 requires the claims for money to be sorted, the algorithm in EWD116 has removes this constraint.

Also in EDW 116 Dijkstra make a remark about different type of claims (in banker’s term, different currencies, for example). Apparently someone has made remarks that there may be different types of resources that need to be managed by the operating system – or Dijkstra himself thought it necessary to add this nuance. Dijkstra writes the algorithm is only applicable for a single type of resource (currency).

From a technical perspective the paper is interesting from an algorithmic perspective, and a story-telling perspective – it illustrates Dijkstra great use of metaphors from the mundane world to explain complex problems.

Also from a historical computing perspective the paper is remarkable. Dijkstra totally discards the possibility of pre-emptive scheduling – that is: have the banker tell one of his clients to pause his business until other clients have returned their money. In not even very modern computing this is very common: processes can be “pre-emptively” put to rest to make sure other processes can progress. Apparently at the time of writing, which we do not know for sure (both EWD’s are not dated; somewhere before 1964?) pre-emptive scheduling was to be invented (or Dijkstra would have been aware for sure).